Marginal tax calculator

This is 0 of your total income of 0. If you are using Internet.

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

It is important to know your tax bracket and how this tax bracket can affect your income tax and the tax liability that you may have.

. Your income puts you in the 10 tax bracket. 0 would also be your average tax rate. This is 0 of your total income of 0.

At higher incomes many deductions and many credits are phased. 0 would also be your average tax rate. This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year.

Knowing and understanding your. 0 would also be your average tax rate. This is 0 of your total income of 0.

Your income puts you in the 10 tax. At higher incomes many. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

0 would also be your average tax rate. 0 would also be your average tax rate. This is 0 of your total income of 0.

At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0. 2020 Marginal Tax Rates Calculator.

At higher incomes many deductions and many credits are phased. Your Federal taxes are estimated at 0. Your Federal taxes are estimated at 0.

Your income puts you in the 10 tax. 0 would also be your average tax rate. At higher incomes many.

Your income puts you in the 10 tax bracket. Calculate your combined federal and provincial tax bill in each province and territory. This is 0 of your total income of 0.

This is 0 of your total income of 0. This is 0 of your total income of 0. Your income puts you in the 10 tax bracket.

This is 0 of your total income of 0. Your Federal taxes are estimated at 0. Your Federal taxes are estimated at 0.

0 would also be your average tax rate. At higher incomes many deductions and many credits are phased. At higher incomes many deductions and many credits are phased.

0 would also be your average tax rate. 0 would also be your average tax rate. Your income puts you in the 10 tax bracket.

Your income puts you in the 10 tax bracket. 0 would also be your average tax rate. 0 would also be your average tax rate.

Standard or itemized deduction. This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. At higher incomes many deductions and many credits are phased.

This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased. Your income puts you in the 10 tax bracket.

Your income puts you in the 10 tax bracket. At higher incomes many. By changing any value in the following form fields calculated.

This is 0 of your total income of 0. Your income puts you in the 10 tax bracket. Your income puts you in the 10 tax bracket.

Your income puts you in the 10 tax bracket. This is 0 of your total income of 0. Javascript is required for this calculator.

Calculate the tax savings your RRSP. Your Federal taxes are estimated at 0. 0 would also be your average tax rate.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Excel Formula Income Tax Bracket Calculation Exceljet

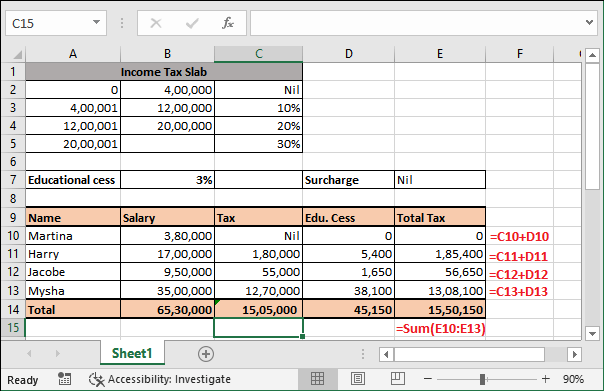

Income Tax Calculating Formula In Excel Javatpoint

Ontario Income Tax Calculator Wowa Ca

State Corporate Income Tax Rates And Brackets Tax Foundation

Marginal Tax Rate Bogleheads

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Marginal Tax Rate Formula Definition Investinganswers

Income Tax Calculating Formula In Excel Javatpoint

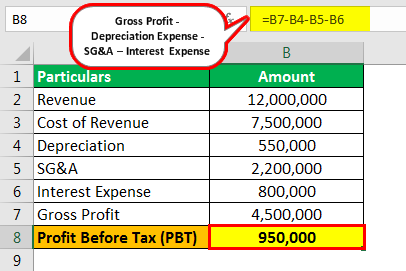

Profit Before Tax Formula Examples How To Calculate Pbt

Self Employed Tax Calculator Business Tax Self Employment Self